|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

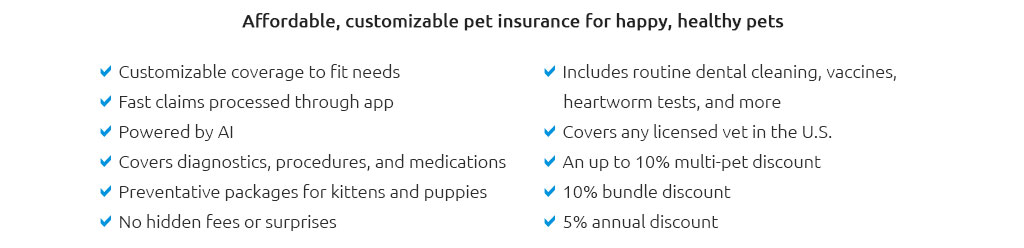

Exploring the Best Cheap Pet Insurance for CatsWhen it comes to ensuring the well-being of our feline companions, the topic of pet insurance often surfaces as a point of consideration. Cats, with their curious nature and occasional health quirks, can benefit greatly from a safety net that doesn’t break the bank. Navigating the landscape of affordable pet insurance requires a keen eye for detail and an understanding of what each policy offers. Here, we embark on a journey to unravel the complexities of finding the best cheap pet insurance for cats, focusing on what to expect and how to make informed decisions. First and foremost, it’s crucial to recognize that “cheap” doesn’t necessarily mean inadequate. There are numerous insurance providers that offer comprehensive coverage at a price point that won’t strain your budget. The key is to discern which plans provide the most value, taking into account both cost and coverage. As you delve into this endeavor, expect to encounter a variety of options, each with its own set of advantages and limitations. Understanding Coverage One of the primary aspects to consider is the scope of coverage. Most affordable pet insurance plans cover essential aspects such as accidents and illnesses, but it’s worth noting that some may also include wellness care, albeit to a limited extent. When evaluating policies, pay attention to what is included and, perhaps more importantly, what is excluded. Common exclusions can include pre-existing conditions, certain hereditary issues, and routine care. A policy that outlines these clearly is indicative of transparency, which is a valuable trait in an insurance provider. Comparing Plans To find the best cheap pet insurance for your cat, a comparative approach is advisable. Start by listing out potential providers and closely examining their offerings. A side-by-side comparison can reveal differences in premium costs, deductibles, and reimbursement rates. It’s also beneficial to read reviews and testimonials from other pet owners. These firsthand accounts can provide insight into the reliability of the insurer, the ease of filing claims, and the overall customer service experience. Considering Deductibles and Premiums One must also ponder the balance between deductibles and premiums. Typically, a lower premium comes with a higher deductible. This means that while you save on monthly costs, out-of-pocket expenses could be higher in the event of a claim. It’s important to align your choice with your financial situation and risk tolerance. For some, a slightly higher premium that reduces the deductible might be more manageable in the long run. Evaluating Long-Term Benefits Furthermore, consider the long-term benefits of the policy. Some insurers offer incentives for renewing policies, such as decreasing deductibles for claim-free years or loyalty discounts. These can significantly enhance the value of a policy over time. Additionally, look into the insurer's track record regarding premium hikes as your pet ages. A stable rate can contribute to long-term affordability. Subtle Opinions and Recommendations In my experience, companies like Embrace and Spot have garnered positive feedback for their cost-effective and comprehensive plans. These providers are often praised for their customer service and straightforward claims processes, which are pivotal when emergencies arise. However, it's always advisable to conduct personal research and choose a provider that aligns with your specific needs and expectations. In conclusion, finding the best cheap pet insurance for cats is a balancing act of evaluating cost versus coverage. By understanding the nuances of what each plan offers, comparing options, and considering both short-term and long-term implications, you can secure a policy that provides peace of mind without a hefty price tag. Remember, the ultimate goal is to safeguard your beloved feline’s health while maintaining financial prudence. Happy hunting! https://thecatsite.com/threads/best-pet-insurance.358248/

One of my biggest stress about rescuing two semi feral cats are the vet bills. Is pet insurance a good deal? Does it really cover blood tests, ... https://www.cbsnews.com/news/how-to-get-cheap-pet-insurance-according-to-veterinarians/

How to get cheap pet insurance, according to veterinarians ... Choosing one of the cheapest dog breeds to insure or cheapest cat breeds to insure ... https://www.thetimes.com/money-mentor/pet-insurance/best-pet-insurance

How to make pet insurance cheaper. If you have several pets it's often ...

|